21 Silicon Valley Startups Raised $650 Million - Week of November 4, 2024

🇸🇦 When Will IPO Outlook Turn Positive? 💰 Cyberstarts' Unicorn Machine Came Conflict Of Interest Mess 🇹🇼 No Taiwan No AI 🇨🇳 MiniMax Talkie Chatbot Scores Big 🗞️ Washington Post Lost 250K Subs

🇸🇦 When Will the IPO Outlook Turn Positive? — I am so grateful to have joined the Future Investment Initiative 8 panel on the evolving IPO landscape in the US, Hong Kong and Europe this past week. Despite global IPO activity declining over the past few years, this conversation underscored some key insights for founders and investors:

Average time for a company to go public has increased significantly compared to the 1990s. During the ’90s tech boom, startups typically went public within 4-5 years after founding. Today, that timeline has stretched to around 10-12 years. This shift is due the rise of private capital, allowing companies to stay private longer; increased regulatory scrutiny in public markets; and the preference for established revenue models before IPO.

Roughly 80% of U.S. IPOs are now managed by five major investment banks: Goldman Sachs, Morgan Stanley, JPMorganChase, Bank of America & Citi - A shift from the 1990s, when IPO underwriting was more diversified among a broader range of investment banks and boutique firms.

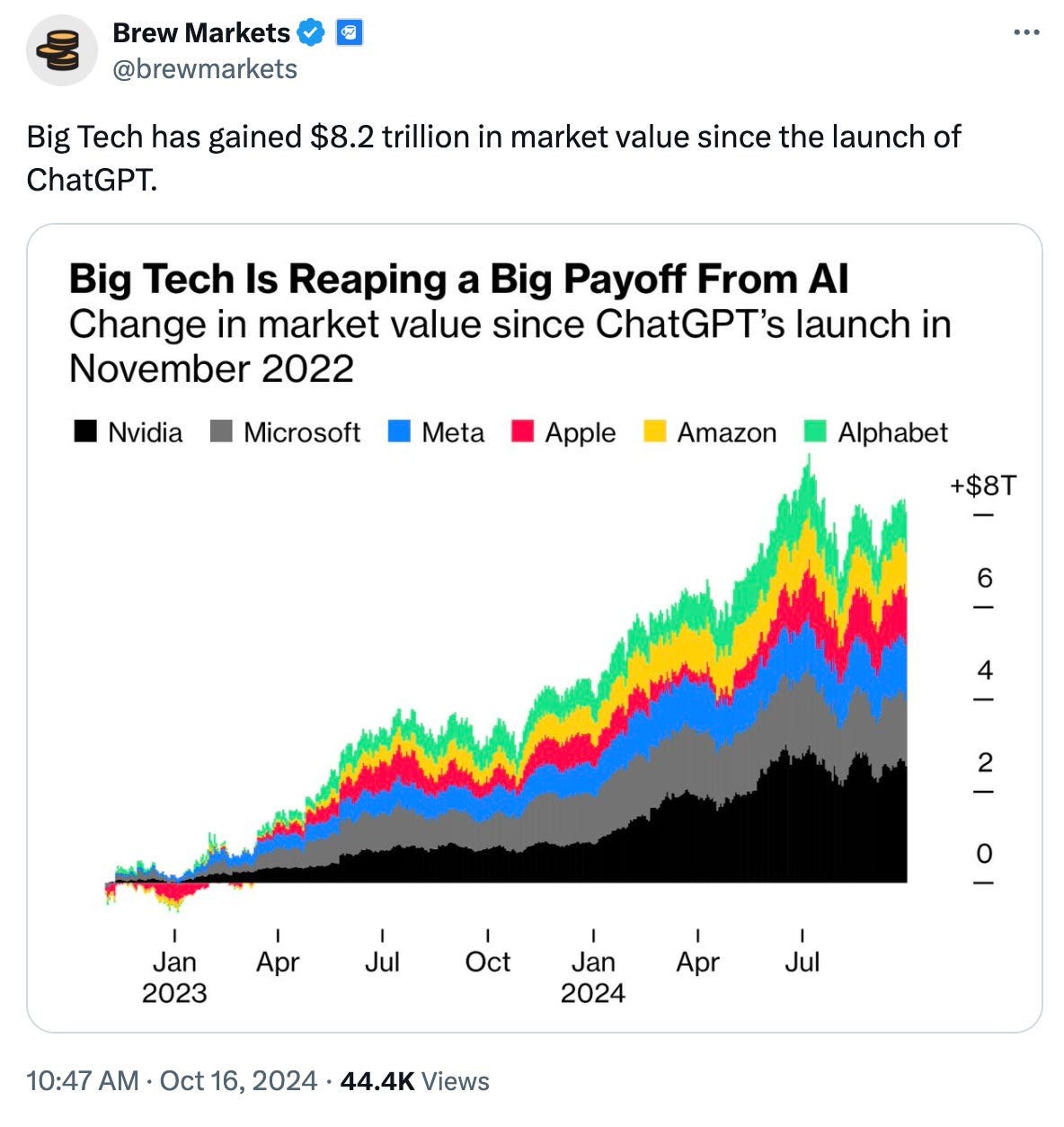

BigTech has gained an estimated $8.2 trillion in market value since the launch of ChatGPT:

4. 10 public companies that have reached the trillion-dollar market cap of which nine can be bought and sold on U.S. exchanges:

Apple

Microsoft

Nvidia

Alphabet

Amazon

Meta

Tesla

Berkshire Hathaway

Taiwan Semiconductor Manufacturing

Saudi Aramco

5. Hong Kong IPO market is slowly picking up with Midea Group $4.7 billion IPO debut last month.

💰 Cyberstarts Built a Cybersecurity Unicorn Machine. Then Came a Conflict Of Interest Mess — Cyberstarts’ Sunrise model recruits CISOs as advisors for product development, with an incentive to earn tens of thousands of dollars as they deepen ties with Cyberstarts portfolio companies. Outsiders questioned why corporations would sign six-and-seven-figure contracts with startups as small as some of Cyberstarts’ portfolio companies. Read more.

🇹🇼 No Taiwan, No AI — Right now, the world depends on Taiwan for almost all of the critical hardware needed to power AI. But how is its tech industry adapting to the growing threat of conflict with Beijing? AI’s $1.3 trillion future increasingly hinges on Taiwan.

🇨🇳 Chinese AI unicorn MiniMax Scores Big in US with Talkie Chatbot Entertainment App — Globally, Talkie recorded 17M downloads in the first eight months of the year, trailing Character.ai‘s nearly 19M downloads in the same period (who also had a tragedy happen this past week as well). Using Gen AI, both apps enable users to create and have conversations with virtual characters based on fiction or real people - but is it safe for kids? Read more.

💰 Warren Buffett is Positioning like a Recession is Coming

🗞️ More than 250,000 Subscribers Have Left The 'Washington Post' Over Withheld Endorsement — Despite Jeff Bezos’ op-ed The hard truth: Americans don’t trust the news media, 250K subscribers still unsubscribed from The Washington Post. The Los Angeles Times also saw resignations and loss of subscriptions after owner blocked a Harris endorsement. Biotech billionaire Patrick Soon-Shiong, who bought the newspaper in 2018. wouldn’t let the board endorse Harris.

Last week a total of 21 startups raised $649.5M in funding, 2 Exits:

$320.3M goes to 9 Enterprise startups

$8.7M goes to 1 FinTech startup

$9M goes to 1 InsurTech startup

$11M goes to 1 Edtech startup

$12.5M goes to 2 Healthcare startups

$219M goes to 3 BioTech startups

$4M goes to 1 Home Energy Efficiency startup

$27M goes to 1 Robotics startup

$38M goes to 2 Manufacturing startups

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Armis Security (cyber exposure management and security) raised $200M Series D led by Alkeon Capital, General Catalyst

Spot AI (video AI agents) raised $31M Series B led by Qualcomm Ventures

Browserbase (headless web browser management platform for AI) raised $21M Series A led by Kleiner Perkins and CRV

Decart (AI research lab) raised $21M Seed led by Sequoia Capital

Abstract Security (security operations platform) raised $15M Series A led by Munich Re Ventures

GMI Cloud (AI-native GPU cloud provider) raised $15M Series A led by Headline Asia

Bifrost AI (generative 3D data platform) raised $8M Series A led by Carbide Ventures

Persana AI (sales intelligence platform) raised $2.3M Seed led by Race Capital & Y Combinator

FinTech

Sapien (autonomous financial analyst) raised $8.7M Seed led by General Catalyst

Fondo (bookkeeping platform for startups) raised $7M Seed led by from Y Combinator, Liquid2 Ventures, Transmedia Capital, GMO Venture Partners and

Catalyst

InsurTech

Delos Insurance Solutions (wildfire risk property insurance solution) raised $9M Series A led by HSBC Asset Management

Edtech

Buddy AI (AI English tutor app for kids) raised $11M Seed led by BITKRAFT Ventures

Healthcare

CredibleMind (personalized mental wellbeing platform) raised $7.5M Series A led by Horizon Mutual Holdings

Cornerstone AI (AI software solution for healthcare data analysis) raised $5M Seed led by Acrew Capital

BioTech

Evommune (chronic inflammatory disease therapies) raised $115M Series C led by RA Capital Management, Sectoral Asset Management

Kivu Bioscience (antibody-drug conjugate cancer therapies) raised $92M Series A led by Novo Holdings

Aralez Bio (engineered enzymes) raised $12 Series A led by Spero Ventures

Home Energy Efficiency

HomeBoost (home energy platform) raised $4M Seed from True Ventures, Gigascale Capital, and Incite.org

Robotics

Third Wave Automation (autonomous high-reach forklifts) raised $27M Series C led by Woven Capital

Manufacturing

Merlin Solar (flexible solar panels) raised $31M Series B led by Fifth Wall

Endeavor (manufacturing automation AI platform) raised $7M Seed led by Craft Ventures

IPO & M&A (300 miles radius from Silicon Valley)