21 Silicon Valley Startups Raised $545.2 Million - Week of October 14, 2024

💰 Why Vertical LLM Agents Are New $1B Opportunities 🇹🇼 Investors Bullish on Taiwan 💰 Is US Sovereign Wealth Fund a Bad Idea? 🏆 AI took Nobel Prizes by Storm 🚀 Elon Had an 'Insane' Launch Week

Hello from beautiful Tokyo! 🇯🇵🍣🍜 I am in Tokyo teaching at the VCUnlocked program in Tokyo hosted by 500 Global and JETRO this week.

On November 6, I am hosting an invite-only meetup called How to Recruit, Build, and Scale World Class Engineering Teams where seasoned founders and engineering leaders from Microsoft, Linkedin, Coursera, BEA Systems, Sun Microsystems, and Databricks will share proven strategies to build and grow exceptional engineering teams. If you are a technical founder and want to join this conversation, 👉 apply to attend!

💰 Why Vertical LLM Agents Are The New $1 Billion SaaS Opportunities — Jake Heller, the co-founder and CEO of Casetext grew his legaltech company from 0 to $100M in revenue in 10 years, then sold the company to Thomson Reuters for $650M in cash in 2023. Two months later he launched Co-council (powered by GPT-4). I like his test-focused 100% accuracy approach in building Co-council, and how he thinks that all SaaS are “just super-wrappers around databases.” Watch this Y Combinator Roundtable.

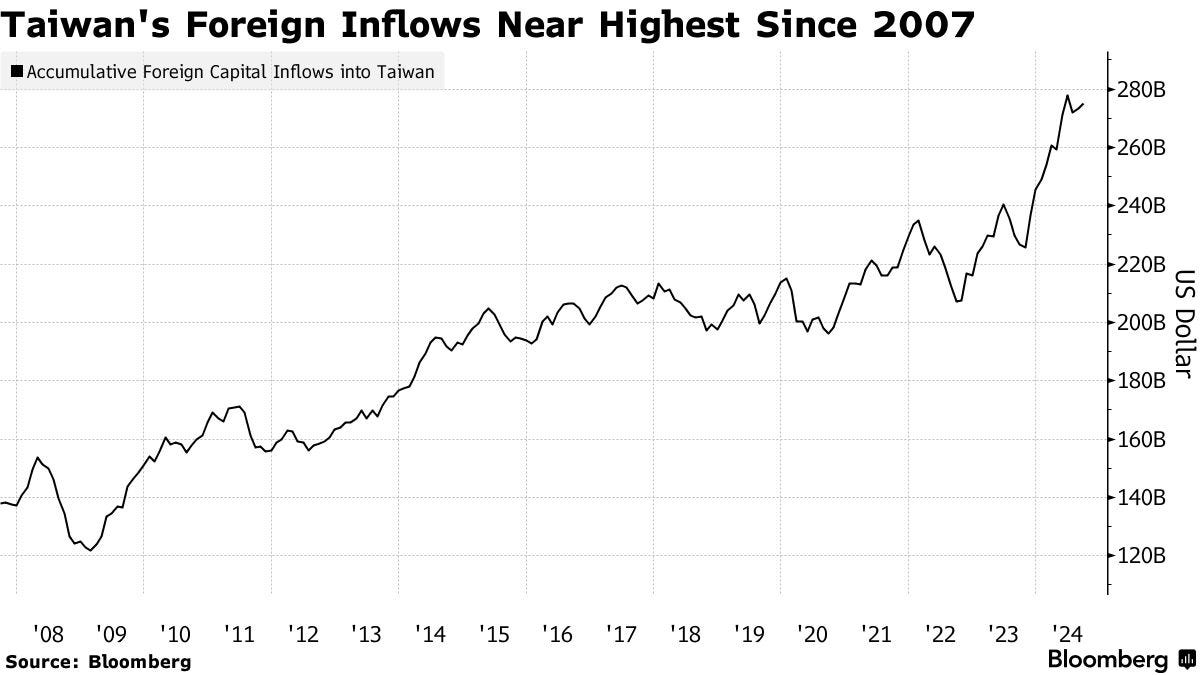

🇹🇼 Global Investors are Hoarding Cash in Taiwan Betting on AI — Taiwan has long been an attractive market for global investors, and net inflows from overseas funds hit $275 billion on a cumulative basis in September. The dry powder available to foreign investors shows how quickly money may flow back into Taiwanese stocks, including TSMC and Foxconn. Read more on Bloomberg.

💰 Is an American Sovereign Wealth Fund Such a Bad Idea? — Members of both the Biden administration and the Trump campaign have floated the idea of an American sovereign wealth fund. That idea, for the most part, has been derided by economists. Take a listen on NPR.

🚀 Elon Had an 'Insane' Launch Week is Understatement - Last week, Elon not only unveiled the Robovan, Optimus and Robotaxi at Tesla's We. SpaceX’s Starship program also moved closer to a fully reusable launch system. The successful return and capture of the Super Heavy booster – an enormous rocket standing 71 meters tall and weighing over 600,000 pounds – using mechanical arms on the launch tower, just seven minutes after liftoff is just astonishing. So fun listening to Kimbal Musk’s comment of the launch. No freaking way!

🏆 AI took Nobel Prizes by Storm - A.I. is coming for science. The Nobel Prize in Physics was awarded to John Hopfield and Geoffrey Hinton who helped computers “learn” closer to the way the human brain does. A day later, the Nobel Prize in Chemistry went to three researchers for using AlphaFold (was trained on a databank ) to invent new proteins and reveal the structure of existing ones — a problem that stumped biologists for decades, yet could be solved by A.I. in minutes.

🍕 Nina Khan Wants to Breakup Google — Sundar Pichai joined Google in 2004 as a product manager, and became the CEO in 2015 then CEO of Alphabet in 2019. Watch his comment on the breakup lawsuit, AI and the future of Alphabet. I’m still amazed that Google has over 180,000 employees (sounds like IBM to me) with 15 Google products having at least a half a billion users including Search, Chrome, Maps, Gmail, YouTube, Android, Photos and Lens! Watch Sundar’s conversation with David Rubenstein.

💰 What VCs Miss Out on When They Only Back Repeat Founders — You can only lose 1x of your money on an investment, but you can lose 1,000x on an investment you miss. Both the best and worst performing founders tend to be first-timers. First-time entrepreneurs, driven by a pursuit of their life’s work, may create the next Facebook, Airbnb or Amazon, while others fail spectacularly and quit entrepreneurship for good. By pattern-matching too strictly to serial founders, VCs may lower their failure rates, but also risk excluding themselves from the highest potential returns. Read more about the “risk of missing out” on Crunchbase.

🪙 Why Visa is Launching VTAP Tokenization Platform for Banks — Visa’s head of crypto, Cuy Sheffield, just announced its new tokenization platform for banks called the Visa Tokenized Asset Platform, or VTAP. They have been working on this for the past 5 years with the goal to let more than 15,000 banks use blockchain technology for things like tokenized deposits. Sounds like a Ripple competitor to me! Watch this video on Bloomberg Crypto.

Last week a total of 21 startups raised $545.2M in funding, 0 M&As:

$122.4M goes to 10 Enterprise startups

$28M goes to 1 FinTech startup

$35.5M goes to 2 InsurTech startups

$15M goes to 1 HR startup

$135M goes to 1 Legal Tech startup

$199.3M goes to 5 Healthcare startups

$10M goes to 1 BioTech startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Relyance AI (data trust and governance platform) raised $32M Series B led by Thomvest Ventures

Unify (go-to-market platform) raised $19M Series A led by Emergence Capital, Thrive Capital

Distributional (AI testing platform) raised $19M Series A led by Two Sigma Ventures

Vessl AI (MLOps platform) raised $12.2M Series A from from A Ventures, Ubiquoss Investment, Mirae Asset Securities, Sirius Investment, SJ Investment Partners, Wooshin Venture Investment, and Shinhan Venture Investmen

Lightdash (business intelligence platform) raised $11M Series A led by Accel

Kiva AI (data compliance) raised $7M Seed led by CoinFund

Third Dimension AI (3D generative AI) raised $7M Seed led by Felicis

ApertureData (multimodal AI database) raised $5.3M Seed led by TQ Ventures

Truthset (data validation-as-a-service) raised $5M Series A led by Data Point Capital

Vultron (AI-powered proposal development for public sector raised $4.9M Seed led by Craft Ventures, Long Journey Ventures

FinTech

Numeric (AI accounting automation) raised $28M Series A led by Menlo Ventures

InsurTech

Pinpoint Predictive (insurance risk assessment) raised $23M Series A led by Markd

COVU (AI-native services for insurance agencies) raised $12.5M Series A from Benhamou Global Ventures, ManchesterStory, and Markd

HR

Zeal (modern payroll platform) raised $15M Series B led by Portage Ventures

Legal Tech

EvenUp (personal injury AI and document generation) raised $135M Series D led by Bain Capital Ventures

Healthcare

CytoVale (rapid sepsis diagnostic solution) raised $100M Series D led by Sands Capital Ventures

Suki (AI voice solutions for healthcare) raised $70M Series D led by Hedosophia

InterVene (medical device for chronic venous insufficiency) raised $13M Series A led by RiverVest, Treo Ventures

RadiantGraph (personalized engagement for healthcare) raised $11M Series A led by M13

Stream (workers’ compensation medical document management) raised $5.3M Seed led by Spark Capital

BioTech

IPO & M&A (300 miles radius from Silicon Valley)

N/A