19 Silicon Valley Startups Raised $756.2M - Week of July 14, 2025

🧭 The Browser Isn’t the Future of AI Search 🌉 What I Learned From Professor Alvin Cheung 🌀 The Windsurf–OpenAI Deal Is Off. Google Gets the CEO. 📈 Who’s Winning in Hong Kong’s Tech IPO Boom

Happy Monday!

First up, congrats to Kumar Saurabh and the AirMDR team for raising $10.5M Seed led by Race Capital! AirMDR is the future of MDR service for enterprise!

🌉 What I Learned From Professor Alvin Cheung — Last week, I had the pleasure of hosting Professor Alvin Cheung from UC Berkeley’s RISE Lab for dim sum and a chat about AI at the FoundersHK Summer Social — and I haven’t stopped thinking about the conversations that came out of it.

The room was buzzing — familiar faces, and new ones — all part of Hong Kong’s founder, operator, and investor community here in the Bay Area.

Here are a few ideas that have been echoing in my head since:

🧠 1. AI won’t just change the game — it’ll reshape the field

Especially in sectors like fintech, health, infrastructure, and government, where the systems are old and the inefficiencies are deep.

🧮 2. Prompting isn’t magic — it’s systems thinking

We love to obsess over clever prompts. But Alvin reminded us: “Garbage in, garbage out” still applies. Behind every great prompt is someone who understands the problem deeply.

🗣️ 3. Natural language may be our next programming language

From punch cards → assembly → Python… and now, maybe we just describe what we want. Not code — conversation.

🏗️ 4. Classrooms should feel more like startups

Why ask students to memorize theory when they could be building MVPs — powered by AI agents? Learn by doing, not reciting.

🧰 5. Coding isn’t just a job skill — it’s a way of thinking

In a world where AI can write code, our job is to understand the system behind it. That might matter more than ever. Some say AI may ever slow down experienced open source developers.

Check out our photos on Linkedin.

🧭 The Browser Isn’t the Future of AI Search — This week, both OpenAI and Perplexity launched their own AI browsers, bold moves in a crowded space, but I think it’s just noise.

Now, I say this as someone who’s been in the trenches. Years ago, I helped build Dolphin Browser on Android — we took it from zero to 150 million installs. No small feat. But even then, one thing was clear: the browser isn’t the future.

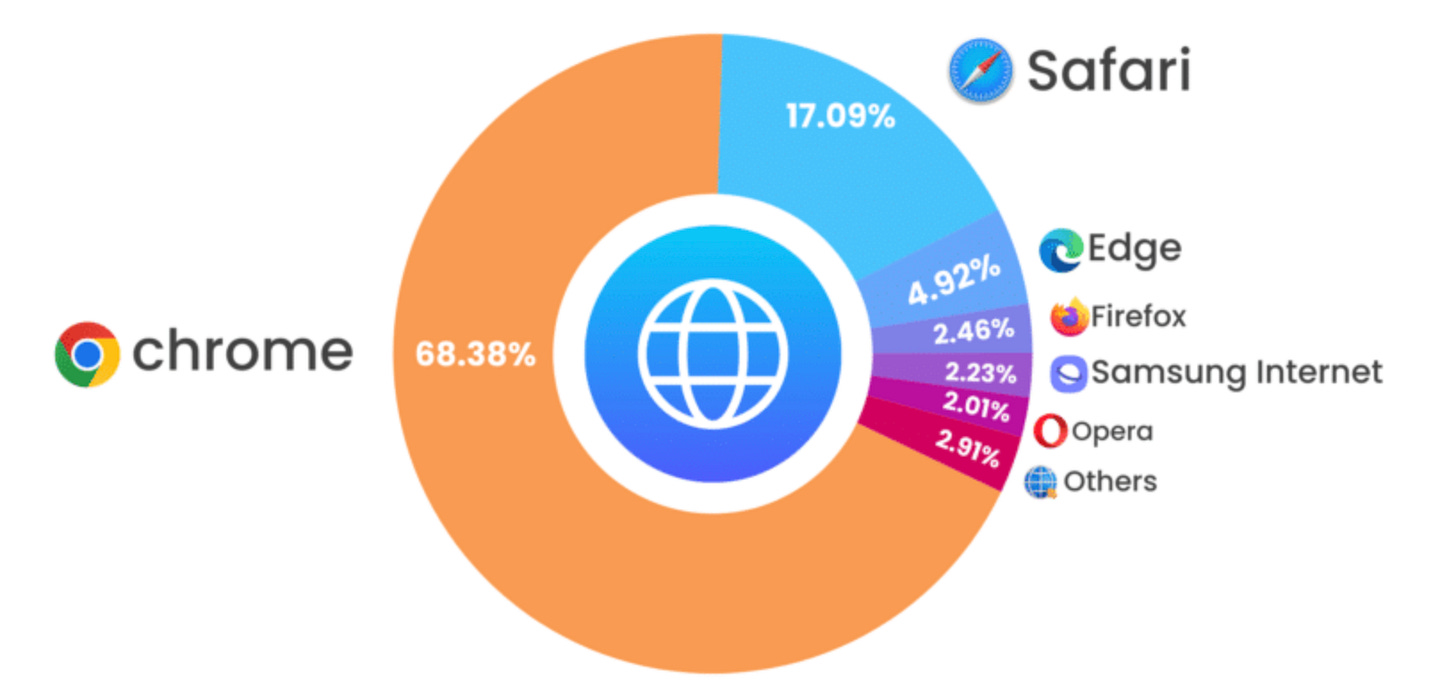

On mobile especially, changing your default browser is near-impossible for most users. The numbers speak for themselves. Samsung has spent two decades trying to break through and still holds just 3.4% of the global share. Brave, launched by Mozilla’s former CEO in 2016, sits at around 1%.

This isn’t a failure of vision or execution. It’s a reflection of how deeply embedded the browser interface is — and how tough it is to displace.

The real opportunity? The future of AI-powered search lives in conversation — not behind tabs or address bars. If AI is going to change how we access information, it shouldn’t live in yet another browser no one uses. It should live inside the apps we already talk to: chat apps, voice interfaces, even messaging threads.

If these companies want to shape the future, they’ll need to meet users where they already are — not ask them to reset defaults most people can’t even find.

🌀 The Windsurf–OpenAI Deal Is Off, but Google Gets the CEO — In a twist that feels both inevitable and surprising, the Windsurf–OpenAI deal is dead — and Windsurf’s CEO is headed to Google.

At first glance, it’s easy to score it like a game: Google wins. OpenAI loses.

But zoom out, and the real loss might belong to the developer community.

Windsurf wasn’t just another AI startup. It was beloved by developers. For a brief moment, it looked like it might become the platform for AI-assisted coding — a GitHub Copilot challenger with momentum and heart.

Now? The company is fractured. The product’s future is unclear. And the investors — once bullish on its potential — are left holding what looks like a skeleton crew and an unknown roadmap.

This isn’t a new story in tech. We’ve seen it before: An aggressive acquirer. Founders get excited. And somewhere along the way, the magic gets lost.

Windsurf could’ve been the crown jewel of AI tooling. Oh well…

📈 Who’s Winning in Hong Kong’s Tech IPO Boom — As I mentioned last week, when it’s time to take your company public, look to the Popmart ($43B) and Xiaomi ($197B) playbook: list on the Hong Kong Stock Exchange, build traction in Asia, and turn to global capital on your own terms.

So far in 2025, IPO volumes on HKEX have jumped 8x — from just $1.8B in H1 2024 to $14B in H1 2025, with projections of 100 IPOs and total fundraising exceeding $25.5B by year-end.

Here are some standout companies that seized the HK IPO window this year:

CATL — The world’s largest EV battery maker (38% global market share), and key supplier to Tesla, BMW, Ford, and Mercedes-Benz.

📅 IPO: May 2025 | 💰 Valuation: ~$20B USD / $154B HKD | Read more.CaoCao — China’s #2 premium ride-hailing platform (behind Didi Premium), backed by Geely (parent of Volvo and Lotus).

📅 IPO: June 2025 | 💰 Valuation: ~$2.4B USD / $18.8B HKD | Read more.Unisound AI — Leading Chinese voice recognition and NLP startup, backed by Qiming Venture Partners and Qualcomm Ventures.

📅 IPO: June 2025 | 💰 Valuation: ~$3.7B USD / $29B HKD | Read more.Lens Technology — Key display and glass supplier to Apple, Tesla, Samsung, and BMW.

📅 IPO: July 2025 | 💰 Valuation: ~$15B USD / $117B HKD | Read more.GeekPlus — Robotics startup powering warehouse automation for clients like Nike, Walmart, DHL, and JD.com.

📅 IPO: July 2025 | 💰 Valuation: ~$3B USD / $24B HKD | Read more.

The signal is clear: Asia-first companies are raising at scale on their home turf and using Hong Kong as a global capital gateway.

Last week a total of 19 startups raised $756.2M in funding, 3 exits:

$461.7M goes to 8 Enterprise startups

$6.6M goes to 1 Fintech startup

$38M goes to 1 Edtech startup

$4.5M goes to 1 eCommerce startup

$23M goes to 1 Real Estate startup

$139.4M goes to 4 BioTech startups

$8M goes to 1 Climate Tech startup

$55M goes to 1 Transportation startup

$20M goes to 1 Construction startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

MaintainX (AI-powered maintenance and asset management platform) raised $150M Series D led by Bessemer Venture Partners, Bain Capital Ventures

Harmonic (mathematical superintelligence engine) raised $100M Series B led by Kleiner Perkins

LangChain (AI orchestration framework) raised $100M Series B led by IVP

Spacelift (infrastructure orchestration platform) raised $51M Series C led by Five Elms Capital

Sundial (AI-powered data analytics platform) raised $23M Series A led by GreatPoint Ventures

Foundation EGI (engineering general intelligence platform) raised $23M Series A led by RRE Ventures, Translink Capital

AirMDR (AI-powered MDR service for enterprise) raised $10.5M Seed led by Race Capital

ZeroEntropy (adaptive AI data retrieval engine) raised $4.2M Seed led by Initialized Capital

Fintech

Layer (embedded accounting platform for SMB) raised $6.6M Seed led by Emergence Capital

eCommerce

OneText (shopping by text) raised $4.5M Seed from Khosla Ventures, Coatue, Citi Ventures, Y Combinator, Good Friends

Edtech

Honor Education (AI learning platform) raised $38M Series A from Alpha Edison, Wasserstein & Co, Audeo Ventures, Interlock Partners, New Wave Capital

Real Estate

BioTech

Renasant Bio (small molecule treatments for polycystic kidney disease) raised $54.5 Seed led by 5AM Ventures

Centivax (universal immunity platform) raised $45M Series A led by Future Ventures

Aqtual (rheumatoid arthritis treatments) raised $31M Series B from Bold Capital, Bold Longevity Growth Fund, Genoa Ventures, Manta Ray Ventures, and Yu Galaxy

Synfini (small molecule drug discovery) raised $8.9M Seed led by JSL Health Capital

Climate Tech

WaHa (atmospheric water generation systems) raised $8M Series A led by Christian Tiringer, Mike Phillips

Transportation

ServiceUp (vehicle repair management platform) raised $55M Series B led by PeakSpan Capital

Construction

Parspec (construction supply chain platform) raised $20M Series A led by Threshold Ventures

IPO & M&A (300 miles radius from Silicon Valley)