18 Silicon Valley Startups Raised $1.8B - Week of June 2, 2025

💰 How the Big Beautiful Tax Impacts University Endowments 💰 Instinct vs. AI 💰 Unbound Security Closed $4M 🩸 Behind the Curtain: A white-collar bloodbath 📝 Mary Meeker’s AI Trend Report 2025

Happy Monday!

Thrilled to be speaking and judging PITCH at the inaugural Web Summit Vancouver this past week. Great vibes and Vancouver is a gorgeous city.

Some things to read and this watch this week:

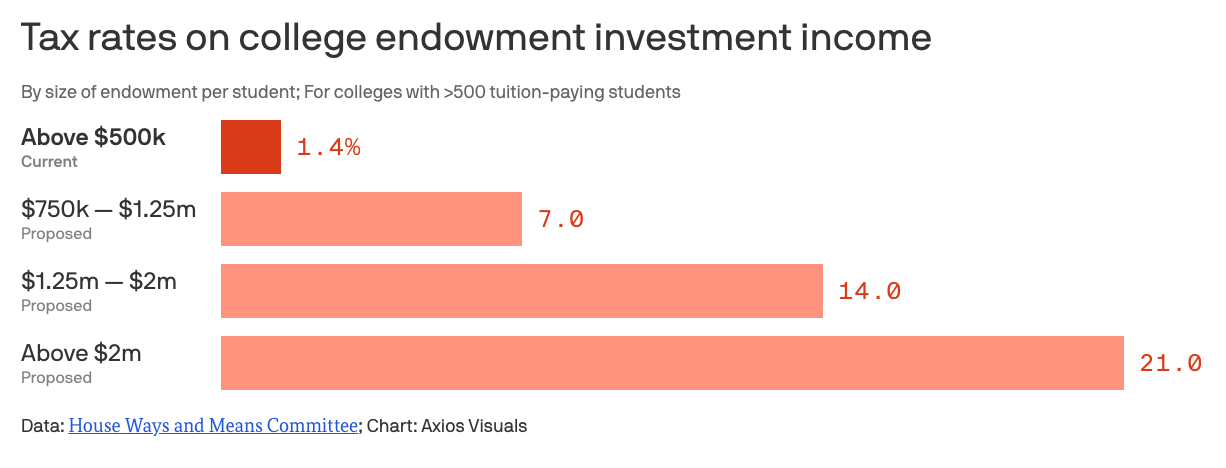

💰 How the Big Beautiful Tax bill Impacts University Endowments — House Republicans’ plan to raise taxes on university endowments could drive the biggest shift to endowments’ investment strategies in a generation. When an endowment pays no tax, it can invest wherever it thinks it can achieve the highest long-term return. When investment income is taxed, however, that creates an incentive to move away from income-generating assets.

Instead, endowments might shift their asset allocation to assets that don't throw off income, writes Anne Duggan of TIFF Investment Management.

Alternative assets like private equity, as well as stocks like Berkshire Hathaway and many ETFs, don't pay dividends and therefore wouldn't be taxable under the new regime.

💰 Instinct vs. AI: The Changing Face of Venture Capital — Last week at Web Summit Vancouver, I had the opportunity to speak on a topic that feels increasingly urgent: “Instinct vs. AI: The Changing Face of Venture Capital.” Here are a few takeaways from my talk:

The AI Funding Boom—Or Concentration? - In Q1 2025, global investment into the AI sector hit $73 billion. That might sound massive—until you look under the hood. $40B went to OpenAI, largely led by SoftBank. $6B to Elon Musk’s xAI. $3.5B to Anthropic. That’s nearly $50 billion concentrated in just three companies. Which means thousands of startups around the world are left competing for the remaining capital. We're in a moment where capital is flowing—but not evenly.

Corporate Venture Is Cool Again — AI has reignited the role of corporate venture capital at an entirely new scale. This isn’t just corporate participation, it’s corporate domination!

Microsoft: Over 106 investments since 2022, including $16B in OpenAI and $2B in Databricks.

Nvidia: 99 companies and counting. $6.6B in OpenAI, $6B in xAI, $2B in Superintelligence, $1.3B in Inflection, and $1B in Scale AI.

Will the Magnificent 7 Build It All? As I mentioned in my recent newsletter: Google didn’t just make a splash at I/O—they dropped a bombshell. 100 announcements. The Gemini app now has 400 million monthly active users — on par with ChatGPT — and over 7 million developers are building with Gemini, a 5x YoY increase. Google processes over 480 trillion tokens a month—that’s 50X what they were doing just a year ago. The takeaway? Big Tech is not asleep at the wheel. They are building fast, at scale, and increasingly for free.

What This Means for Founders — At Race Capital, we looked at ~2,000 AI startups last year. Fewer than 1% reached $1M in ARR within 24 months.

That stat begs the question: Were we right to pass on 98% of them? Or is this just the reality of the landscape? Everything looks like a startup, but nothing feels like a company. What used to take two engineers and six months can now be done by one founder and a prompt.

What’s your moat? In this new AI era, you won’t win because:

You have a slightly better algorithm.

You have access to a better dataset.

You’ve built “better” infrastructure.

In a world where everyone has a hammer, the winners are not the ones who build faster—it’s the ones who build what actually matters.

💰 Unbound Security Closed $4M Seed Round — Congrats to Rajaram Vignesh (former Palo Alto Networks) and the Unbound Security team for closing their $4M seed round. Unbound gives IT teams the visibility and controls they need to safely introduce and manage AI tools in the enterprise. Its AI Gateway plugs into commonly used tools and provides real-time protection, model routing, and usage analytics. Rather than simply blocking prompts, Unbound redacts sensitive content in real time and reroutes high-risk requests to internal, open-source models hosted in the organization’s cloud.

AI is projected to reach $4.8 trillion in market value for the enterprise by 2033 globally — but without proper guardrails, that value is at risk. We, Race Capital, are excited to back as they create a new category of AI infrastructure: one built for safety, observability and cost discipline from day one. Read more on Forbes.

🩸 Behind the Curtain: A white-collar bloodbath — In a quiet San Francisco office, Dario Amodei offers a glimpse into the near future we’ve barely begun to imagine: one where AI doesn’t just assist work—it replaces it. Entry-level white-collar jobs, once the training ground for future executives, are now on the brink. According to Amodei, we could see unemployment spike to 10–20% within five years as AI systems scale rapidly across sectors like finance, law, consulting, and tech.

It’s not just a theory—it’s a quietly unfolding reality. The script is already being written: companies stop backfilling roles, stop hiring altogether, and eventually start replacing people with agents. And then, seemingly overnight, what once looked like automation as augmentation — AI as your assistant — becomes automation as elimination. AI doing the job entirely.

Amodei urges us to stop sugar-coating it. Yes, this revolution may bring astonishing upsides: curing cancer, 10% GDP growth, a balanced federal budget. But at the same time, 1 in 5 people might be without a job. And signs of this shift are already emerging:

Microsoft has laid off 6,000 employees — many of them engineers.

Walmart cut 1,500 corporate roles in a move to “simplify operations.”

CrowdStrike slashed 5% of its workforce, explicitly citing AI as the turning point.

The line between "helping you do the job" and "doing the job instead of you" is eroding fast! What’s most surprising: How little attention most people are paying! We’re living through a major inflection point in human labor—and barely anyone’s looking up. Read more on Axios.

📝 Mary Meeker’s AI Trend Report 2025 — Technological transformation is rewriting the rules of business, society, and power. Google wanted to organize the world’s information. Facebook set out to connect it. Alibaba hoped to make commerce effortless. Today, AI is doing all three at once, and on steroids.

And unlike the internet era, where innovation flowed west to east, this AI moment launched globally on day one. There was no “catching up,” just immediate participation.

But it’s not just tech that’s shifting—it’s geopolitics. The global powers aren’t just competing on trade or territory anymore. They’re competing on who builds the future.

The better bet? That progress will come with pain, but also with promise. That the race to the top will beat the race to the bottom. And that in a world this uncertain, the case for long-term optimism is still one of the smartest bets we can make. Read report on Bond Capital Website.

Last week a total of 18 startups raised $1.8B in funding, 2 exits:

$1.6B goes to 10 Enterprise startups

$3.2M goes to 1 Human Resources startup

$4M goes to 1 Gaming startup

$40M goes to 1 BioTech startup

$51.5M goes to 2 Energy Tech startups

$27M goes to 1 Logistics startup

$6M goes to 1 Construction startup

$2M goes to 1 Wellness startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Grammarly (writing assistant) raised $1B led by General Catalyst

ClickHouse (real-time data processing and analytics) raised $350M Series C led by Khosla Ventures

Snorkel AI (AI data development platform) raised $100M Series D led by Addition

Hex (AI workspace for data analytics) raised $70M Series C led by Avra

Chalk (AI inference data platform) raised $50M Series A led by Felicis

Cerby (identity security platform) raised $40M Series B led by DTCP

Creatify AI (AI video ad platform) raised $15.5M Series A led by Kindred Ventures, WndrCo

Context (AI-native office suite) raised $11M Seed led by Lux Capital

Bito (AI code review platform) raised 5.7M Seed led by Vela Partners

Unbound Security (data security for Gen AI apps) raised $4M Seed led by Race Capital

Human Resources

Spott (AI agents for recruiting) raised $3.2M Seed led by Base10 Partners

Gaming

BioTech

Vivodyne (lab-grown 3D human tissue for drug testing) raised $40M Series A led by Khosla Ventures

Energy Tech

Heron Power (energy infrastructure to connect to grid) raised $38M Series A led by Capricorn Investment Group

GridCARE (power solution for AI data centers) raised $13.5M Seed led by Xora Innovation

Logistics

Pallet (AI workforce for logistics) raised $27M Series B led by General Catalyst

Construction

Neuron Factory (AI coworker platform for construction) raised $6M Seed led by Activant Capital, Colle Capital, Karman Ventures, Punch Capital

Wellness

Maxiom Labs (AI coach for health and fitness) raised $2M Seed led by Conscious Venture Partners

IPO & M&A (300 miles radius from Silicon Valley)