16 Silicon Valley Startups Raised $715.7 Million - Week of March 17, 2025

😊 YC Demo Day - March 2025 🗺️ The AI Agent Market Map 💰 Why did PIF (Scopely) Buy Pokémon Go for $3.5B 💡 5 Things to Know About Intel’s New CEO 💰 Defining Token by a16z

Happy Monday!

Another week in Silicon Valley where two-thirds of all tech workers are foreign-born! Lots of people are in town for GDC (Game Developer Conference) and GTC (Nvidia’s GPU Technical Conference)!

😊 160 Startup Pitches in 6 Hours at YC Demo Day — I always enjoy attending Y Combinator's Demo Day; it allows me to feel the pulse of Silicon Valley, and the Winter 2025 batch this past week didn't disappoint. I cannot believe YC is now 20 years old and has funded more than 53,000 companies! This Demo Day had 160 pitches, each just 90 seconds. Here is a rough breakdown:

80% AI agents tailored to specific roles or industries.

10% Robotics.

5% "Cursor for X."

5% Crypto.

Most startups in this batch are raising $3-5M with valuation ranged from $20M-$30M.

Read more recaps on Techcrunch and CNBC.

🗺️ The AI Agent Market Map by CBInsights — AI agent startups raised $3.8B in 2024 (nearly tripling 2023’s total). CB Insights maps 170+ AI agent startups across 26 categories. Read the full report by clicking here.

💰 Why did Saudi Arabia’s PIF Buy Pokémon Go for $3.5B? — Saudi Arabia's Public Investment Fund (PIF), through its subsidiary Savvy Games Group (owner of Scopely), has agreed to acquire Niantic's gaming division, including the globally successful mobile game Pokémon Go, for $3.5 billion. This acquisition follows Savvy Games Group's $4.9 billion purchase of Scopely in July 2023.

Pokémon Go is among the most popular and profitable mobile games worldwide, boasting over 30 million monthly active users (MAU) and generating over $1 billion in revenue in 2024 alone. The acquisition aligns with Saudi Arabia’s National Gaming and Esports Strategy, which aims to add approximately $13 billion to the Kingdom’s GDP and create 39,000 new jobs by 2030.

💡 Five Things to Know About Intel’s New CEO, Lip-Bu Tan — Former Cadence Design Systems CEO Lip-Bu Tan was appointed CEO of Intel this past week. Lip-Bu is also the founder of Walden International, an early investor in SMIC, often called "China's TSMC." Walden most notably invested in SMIC during its formative years and backed another 25 other Chinese chip startups from 2017-2020, which made him the target of scrutiny from Washington. A key question now: Will he keep Intel unified, or will he split the foundry and design businesses? Read more on WSJ.

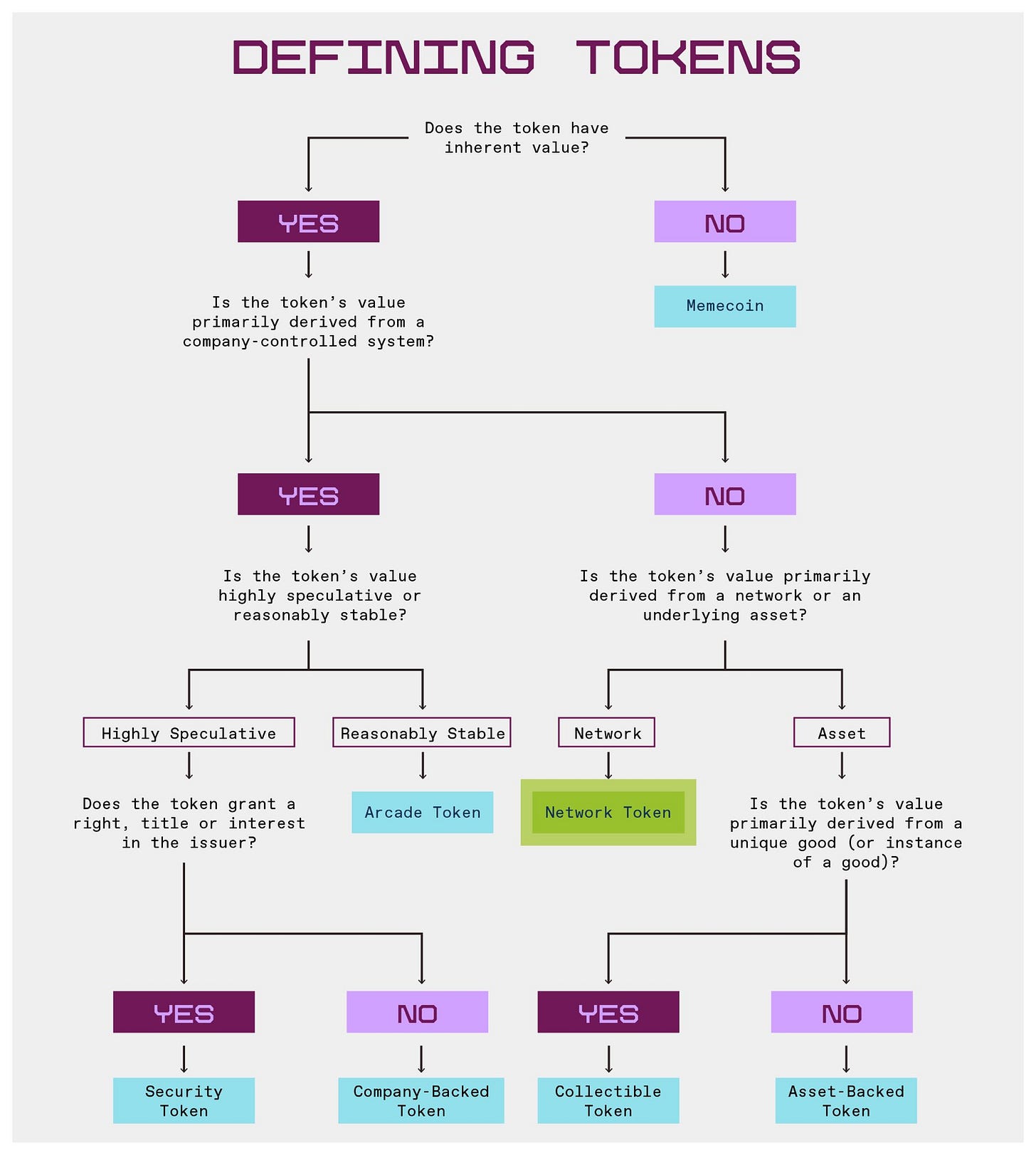

💰 What is a Token? — A16z Crypto presents definitions, examples, and a framework for understanding the 7 categories of tokens we see entrepreneurs building with most often:

Network tokens

Security tokens

Company-backed tokens

Arcade tokens

Collectible tokens

Asset-backed tokens

Memecoins

Read more on on a16z’s Defining Token article:

Last week a total of 16 startups raised $715.7M in funding, 3 M&A:

$179.2M goes to 5 Enterprise startups

$15M goes to 1 FinTech startup

$80M goes to 1 InsurTech startup

$85M goes to 2 Crypto/Web3 startups

$6M goes to 1 Gaming startup

$4M goes to 1 Retail startup

$250M goes to 1 Hardware startup

$35M goes to 1 BioTech startup

$61.5M goes to 3 Environment startups

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Ditto (edge-native mobile database) raised $82M Series B led by Acrew Capital, Top Tier Capital Partners

Cartesia (voice AI) raised $64M Series A led by Kleiner Perkins

Opus Clip (generative AI video editing platform) raised $20M Series B led by Softbank Vision Fund 2

Onyx (AI deep research agent) raised $10M Seed led by First Round Capital, Khosla Ventures

Podqi (intellectual property protection platform) raised $3.2M Seed led by General Catalyst

FinTech

Synctera (banking and payments platform) raised $15M Series A led by Fin Capital, Diagram Ventures

InsurTech

Nirvana Insurance (AI-driven commercial insurance platform) raised $80M Series C led by General Catalyst

Crypto/Web3

Mesh (crypto payments network) raised $82M Series B led by Paradigm

Rakurai (Solana staking protocol) raised $3M Seed led by Anagram

BioTech

Vivace Therapeutics (cancer therapies) raised $35M Series D led by RA Capital Management

Retail

Sayso (interactive shopping platform) raised $4M Seed led by UP Partners

Gaming

Nunu (AI agents for game testing) raised $6M Seed led by A16Z Games Speedrun, Tirta Ventures

Hardware

Celestial AI (optical interconnect technology for AI computing) raised $250M Series C led by Fidelity

Environment

Equilibrium Energy (energy portfolio management) raised $28M Series B led by GS Energy, NRG Energy

Capture6 (water positive carbon removal) raised $27.5M Series A led by Tetrad Corporation

Causal Labs (AI physics models for weather) raised $6M Seed led by Kindred Ventures

IPO & M&A (300 miles radius from Silicon Valley)