16 Silicon Valley Startups Raised $762.3 Million - Week of January 20, 2025

📕 TikTok Refugees Love Xiaohongshu 🛍️ VCs are Buying Traditional Businesses 💰 Goldman is Telling Founders to Reconsider IPOs 📺 SEC Chair Gary Gensler Farewell 🏎️ Why Phoenix is Hot for Hard Tech

Happy Monday!

Today is the second inauguration for Donald J. Trump — love him or hate him, this is going to be an eventful next four years.

Here are a few great things to read/watch this week:

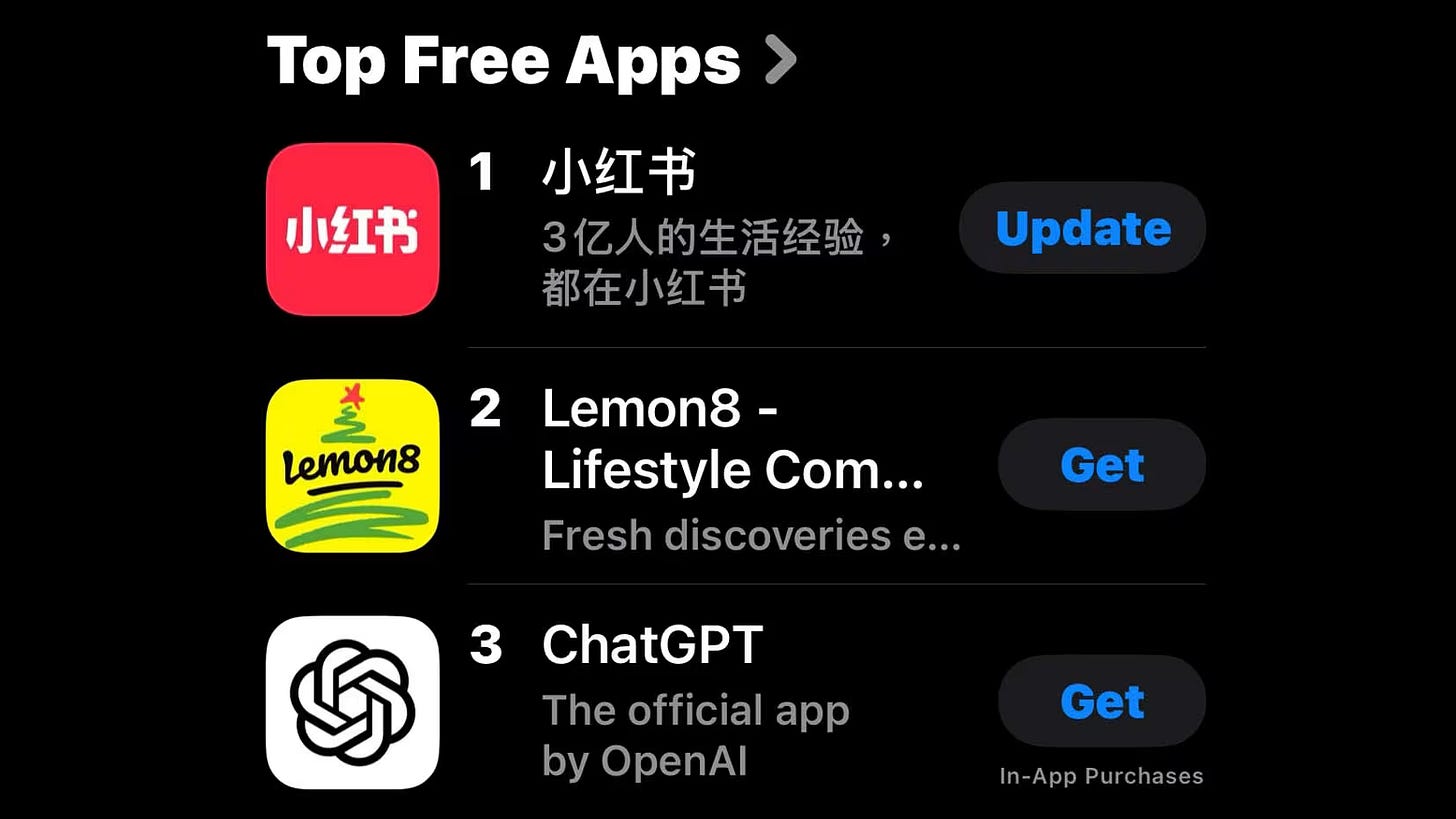

📕 TikTok Refugees are Pouring into “Redbook” & The Americanization of Xiaohongshu 小红书 or Little Red Book — Founded in 2013, Xiaohongshu was founded by Miranda Qu and Charlwin Mao. They raised $917M from Notable Capital, Tencent, Alibaba, Temasek, Hong Shan and DST Global. The closest thing I can think of is that Xiaohongshu is the Pinterest of China - but it has Instagram, Tumblr and TikTok elements as well. Thanks to Xiaohongshu’s interface being bilingual (Chinese and English; and they just released an update that includes a text translation tool like X has) it topped the most downloaded apps in the US this past week. This is how much American users hate American apps (or is it Mark Zuckerberg mostly 😬 the one person most people can agree on hating 😂).

Also, the second top app is Bytedance’s Lemon8 - which itself is a clone of Xiaohongshu. We have achieved social media Möbius.

🛍️ AI-Powered Acquisitions. VCs are Buying Traditional Businesses — Both a16z & General Catalyst are pushing to integrate AI and automation into traditional services companies. Instead of going to market from scratch, a new asset class is emerging around AI enabled roll ups. VCs are pushing for buying traditional services businesses. By automating many of the core workflows with AI enabled software, you could buyout teams in call centers, HOA management, HR solutions, mobile gaming, property management, MSPs, legal, healthcare, and accounting. Read more.

💰 Goldman Sachs is Telling Founders to Reconsider IPOs — What? Last week, David Solomon said startups can scale just as big and get plenty of money in the private markets, without having to deal with the hassle of being a publicly traded company. “It’s not fun being a public company,” he said. “Who would want to be a public company?” Goldman is working more and more with large private companies, including helping Stripe on its $6.5 billion round in 2023. Stripe is part of the growing class of large, private tech companies that are deciding to remain private for much longer. Read more on Techcrunch.

📺 SEC Chair Gary Gensler Bids Farewell — Gary Gensler did his final public interview on CNBC to discuss his tenure leading the SEC, his thoughts on bitcoin and the crypto industry at large, and the future of regulation, etc. I like Joe’s comment on his legacy “You either stood in the way for a total new industry or unable to prevent a huge bubble that is going to end very badly. Either way the outcome were not good.” Click the image to watch on YouTube.

🏎️ Why Phoenix Became a Hot Spot for Tech Companies — Phoenix, Arizona is the fifth largest U.S. city and has been a longtime hub for aerospace and defense. Now it’s becoming the epicenter of semiconductor manufacturing and autonomous vehicles. Taiwan Semiconductor Manufacturing Company(TSMC) recently completed the most advanced chip fab on U.S. soil and has pledged to invest $65 billion in the area. The city is also where Waymo launched its commercial robotaxi service, and now it’s the new home of Amazon’s long-awaited Prime Air drone delivery service. Click the image to watch on YouTube.

Last week a total of 16 startups raised $762.3M in funding, 3 M&As:

$122.8M goes to 4 Enterprise startups

$3M goes to 1 FinTech startup

$8M goes to 1 InsurTech startup

$150M goes to 1 Crypto startup

$47M goes to 1 Legal Tech startup

$121.5M goes to 3 Healthcare startups

$110M goes to 3 BioTech startups

$170M goes to 1 Aerospace startup

$30M goes to 1 Retail startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Instabase (AI-powered unstructured data management platform) raised $100M Series D led by Qatar Investment Authority

Coram AI (LLM-powered video security) raised $13.8M Series A led by Battery Ventures

Thoras AI (adaptive reliability platform) raised $5M Seed led by Wellington Ventures

Rockfish Data (synthetic data generation platform) raised $4M Seed led by Emergent Ventures

FinTech

InsurTech

Rainbow (specialized insurance underwriting platform) raised $8M Series A led by Zigg Capital

Crypto

Phantom (digital asset wallet) raised $150M Series C led by Sequoia Capital & Paradigm

Legal Tech

Eve (AI legal platform) raised $47M Series A led by Andreessen Horowitz

Healthcare

Qventus (AI automation software for health systems) raised $105M Series D led by KKR

Teal Health (at-home cervical cancer screening) raised $10M Seed led by Emerson Collective, Forerunner

Lady Technologies (vaginal health platform) raised $6.5M Series A led by Relentless Consumer Partners

BioTech

Ashvattha Therapeutics (nanomedicine therapeutics) raised $50M Series B led by Tribe Capital

Clear Labs (next-generation DNA sequencing platform) raised $30M Series D

Hinge Bio (antibody therapy) raised $30M Series A led by Point72

Aerospace

Loft Orbital (satellite operator) raised $170M Series C led by AXIAL Partners, Tikehau Capital

Retail

Vividly (trade promotion management platform) raised $30M Series B led by Centana Growth Partners

IPO & M&A (300 miles radius from Silicon Valley)