15 Silicon Valley Startups Raised $508M - Week of June 30, 2025

🧬 Renee Zhao’s Magical Milli-spinner 🧠 Zuckerberg’s Genius List of 2025 💻 Andrej Karpathy: Software 3.0 💰 Shein Heads to Hong Kong for IPO 📈 QSBS May Be Getting an Upgrade

Happy Monday!

🗞️ Interesting Reads this Week

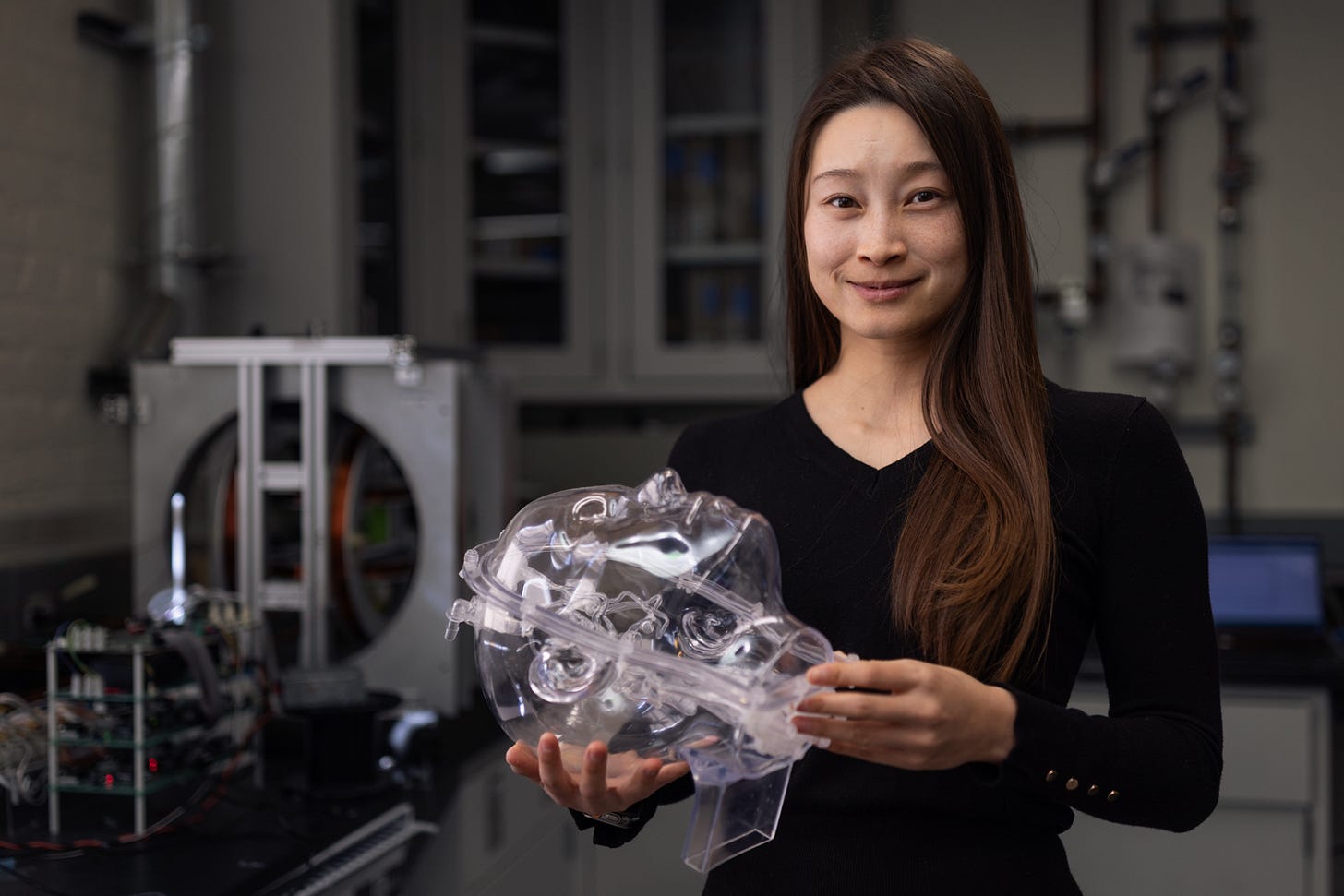

🧬 Renee Zhao’s Magical Milli-spinner — The Milli-spinner, developed by Stanford University’s Zhao Lab, could radically change how we currently treat stroke, heart attack, and kidney stone patients.

The milli-spinner is a tiny, magnetically-driven hollow tube outfitted with fins and slits — capable of spinning through blood vessels to break up clots or blockages. It's been tested in both tethered and untethered formats, and already demonstrated promise in vascular models and pig studies.

This could be one of the most promising microrobotics breakthroughs in years — a blend of precision medicine, magnetic control, and miniaturization that reimagines how internal surgical interventions are performed.

Read more on Fortune.

🧠 Zuckerberg’s Genius List of 2025 — The people on “The List” aren’t just smart — they’re calibrated for the AI era. Most have Ph.D.s from institutions like MIT, Stanford, Berkeley, or Carnegie Mellon. They’ve passed through labs like OpenAI in San Francisco or Google DeepMind in London. They're in their 20s and 30s. And yes — they all know each other.

This is the talent pool that Mark Zuckerberg is quietly indexing: not for their résumés, but for their ability to shape the future of Meta’s Superintelligence Lab.

Read more on WSJ.

💻 Andrej Karpathy: Software Is Changing (Again) — We’re entering the age of Software 3.0, where the most powerful programming interface isn't Python or JavaScript — it’s English.

As Andrej Karpathy puts it, in this new paradigm, developers don’t write logic — they describe intent. Natural language becomes the prompt, and the model does the rest.

For investors, the implications are huge: developer productivity accelerates, software creation gets democratized, and the next great platforms may look less like IDEs — and more like ChatGPT, Cursor, or Replit.

💰 Forget the U.S.; Shein Heads to Hong Kong IPO — After months of speculation and delays, Shein has officially pivoted its IPO plans from the U.S. to Hong Kong.

The move sidesteps increasing regulatory scrutiny from U.S. lawmakers over data privacy, supply chain practices, and geopolitical tensions — all of which had become friction points for a stateside listing.

For investors, this is a signal: the global IPO map is shifting. Companies with Chinese ties or complex international operations may start viewing Hong Kong — not Nasdaq or NYSE — as the path of least resistance to liquidity.

Read more on Reuters.

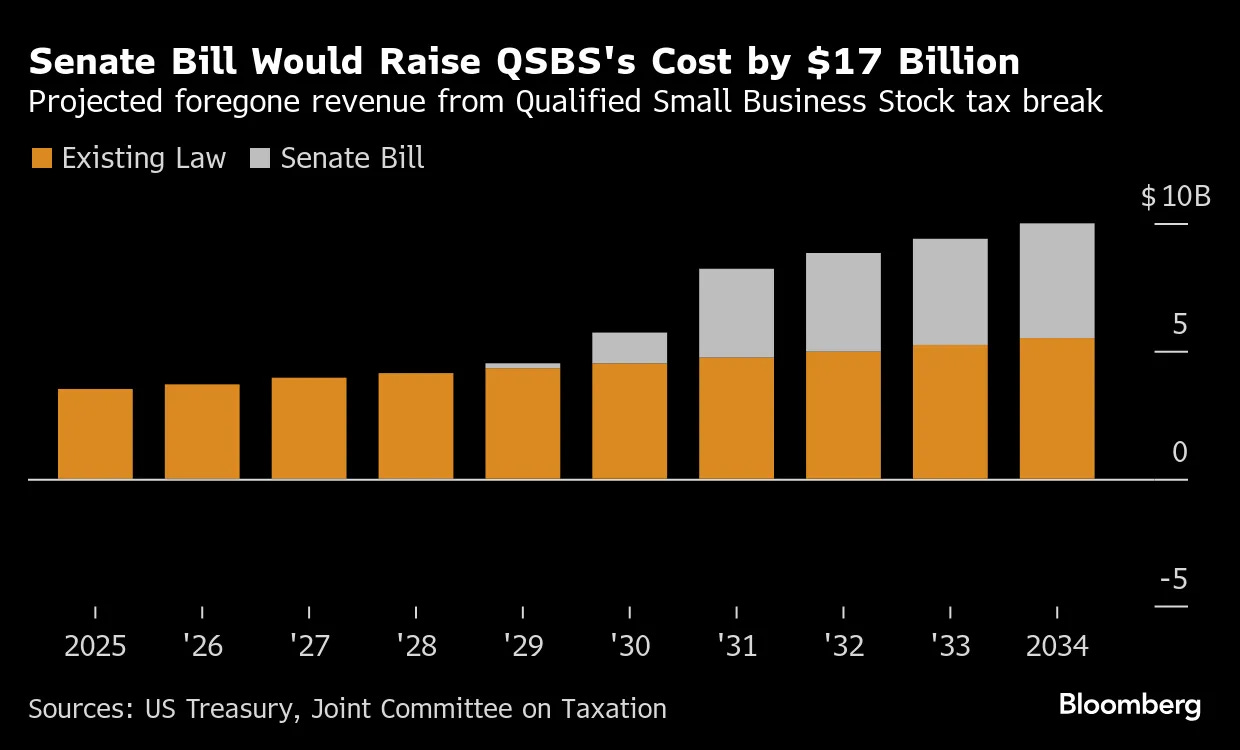

📈 Qualified Small Business Stock (QSBS) May Be Getting an Upgrade — Under current Internal Revenue code, an early investor who puts $30 million into a startup can theoretically receive $300 million in gains — entirely tax-free under QSBS.

Now, that ceiling may rise even higher. A proposed bill would increase the maximum tax-free gain from $10 million to $15 million, with both thresholds indexed to inflation starting in 2027.

Read more on Bloomberg.

Last week a total of 15 startups raised $607.7M in funding, 3 exits:

$246M goes to 6 Enterprise startups

$30M goes to 1 FinTech startup

$23.2M goes to 2 Recruiting startups

$19M goes to 2 Healthcare startups

$96.5M goes to 1 BioTech startup

$6M goes to 1 Logistics startup

$64M goes to 1 Robotics startup

$23M goes to 1 Manufacturing startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Decagon (conversational AI agents for customer experience) raised $131M Series C led by Accel and a16z Growth

LanceDB (AI data infrastructure) raised $30M Series A led by Theory Ventures

Wispr Flow (AI-powered dictation app) raised $30M Series A led by Menlo Ventures

Kognitos (business operations automation) raised $25M Series B led by Prosperity7 Ventures

Eventual (unified multimodal data processing platform) raised $20M Series A led by Felicis

Skyramp (software testing and debugging tool) raised $10M Seed led by Sequoia Capital

FinTech

Spinwheel (Agentic AI for consumer credit ecosystem) raised $30M Series A led by F-Prime Capital

Recruiting

Paraform (hiring marketplace) raised $20M Series A led by Felicis

Jobright (AI job search copilot) raised $3.2M Seed led by Translink Capital

Healthcare

SuperDial (AI agents for healthcare admin phone calls) raised $12M Series A led by SignalFire

Empo Health (remote diabetic foot ulcer management) raised $7M Seed led by Story Ventures

BioTech

Logistics

BackOps AI (logistics automation) raised $6M Seed led by Construct Capital

Robotics

Tacta Systems (dextrous intelligence for robots) raised $64M Series A led by America’s Frontier Fund, SBVA

Manufacturing

Snowcap Compute (superconducting compute platform) raised $23M Seed led by Playground Global

IPO & M&A (300 miles radius from Silicon Valley)