15 Silicon Valley Startups Raised $7.2 Billion- Week of September 30, 2024

💰OpenAI is World’s #3 Most Valuable Private Company 💣 Microsoft Wants to Reboot Three Miles Island ️👮“Fake it Till you Make it” isn't an Excuse for the SEC 💰 50% Top US IPOs in Q3 2024 Are Chinese

Happy Monday from a very hot San Francisco 🥵

Here are a few great things to read & watch this week:

💰OpenAI is Now the World’s #3 Most Valuable Private Company — With a valuation of $157 billion, it is only behind Bytedance and SpaceX. OpenAI is now worth more than Intel and is on par with Uber and Goldman Sachs. In addition to $6.6 billion in equity financing, OpenAI also raised $4 billion in debt. It's hard to imagine $10 billion will give them two years of runway. Want to learn more, here is a quick recap on OpenAI Dev Day 2024.

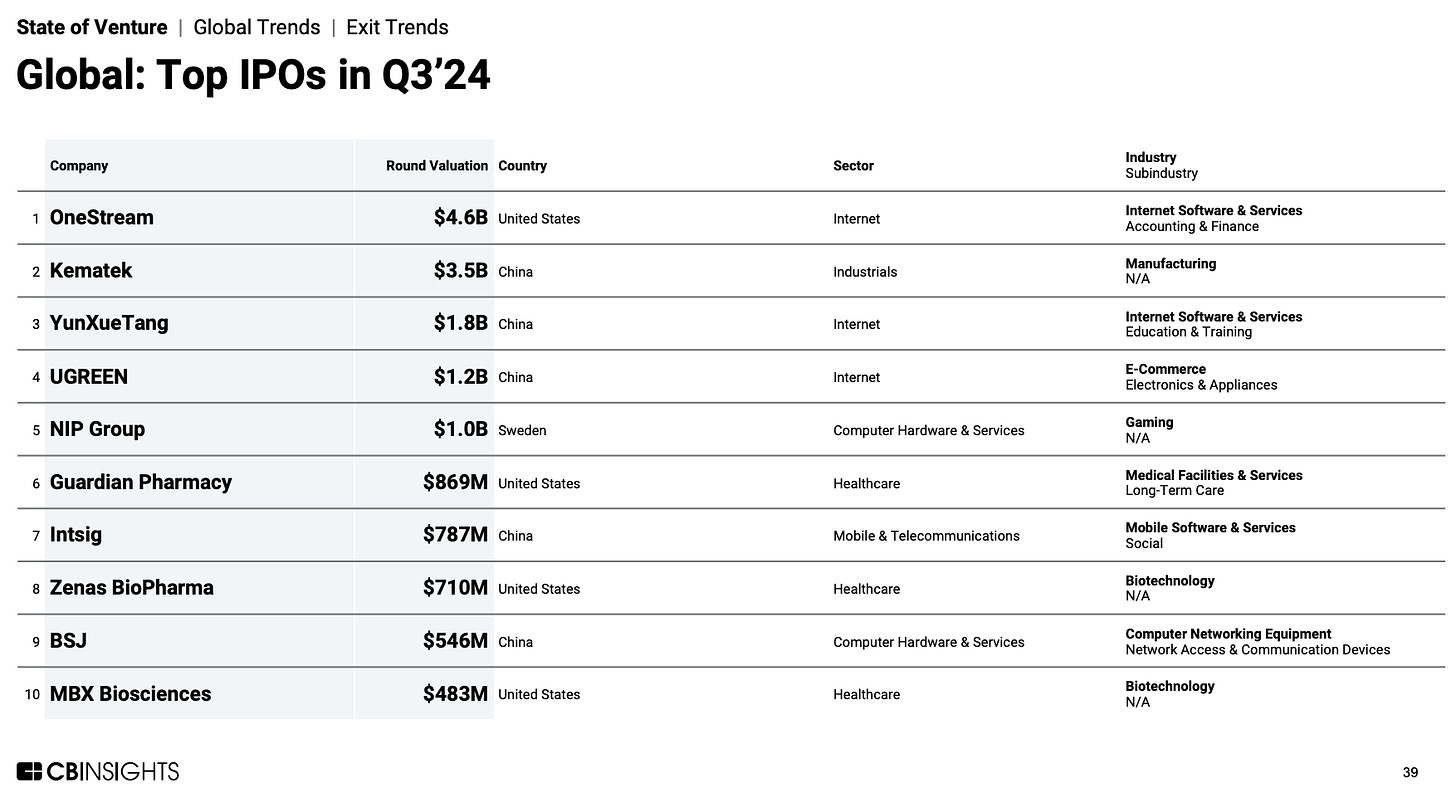

💰 50% of the Top US IPOs in Q3 2024 Are Chinese Companies - Check out the latest CBinsights’s State of Venture Report - Q3 2024.

🔊 Notebook LLM by Google is Really Cool — Audio Overview is a fun new feature of Google’s NotebookLM which is getting a lot of attention right now. It generates a one-off custom podcast against content you provide, where two AI hosts start up a “deep dive” discussion about the collected content. This back-and-forth conversation is so natural and sounds so real.

💣 Microsoft Wants to Reboot Three Miles Island’s Nuclear Power Plant — Microsoft is in search of so much clean power that it is willing to reboot Three Mile Island, the site of the worst commercial nuclear accident in the US. ChatGPT requires a lot more energy than Google search. Some of these AI data centers are consuming as much electricity as San Francisco. Great podcast by WSJ.

️📜 AI Policy Should be Based in Science, Not Science Fiction — With SB-1047 defeated, a group of scientists (including Ion Stoica and Li Fei‑Fei) is giving a sound plan for taking a scientific approach to studying actual risks and mitigating harm. Key ideas: Let’s empower researchers to study AI risks and increase transparency of AI systems. Read A Path for Science and Evidence‑based AI Policy.

👮 “Fake it Till you Make it” isn't an Excuse for Fraud — SEC alleged that the co-founder of Skael (workplace automation) raised more than $30M from investors by claiming it had as much as $7M in ARR, when that actual figure was no more than $170K. SEC also brought charges against the founders of Medly Health (nurse network) and alleged that three executives defrauded investors and raised over $170M by providing phony financial information. Take a listen.

This week a total of 15 startups raised $7.2B in funding, 1 M&As:

$7.2B goes to 9 Enterprise startups

$3.9M goes to 1 Legal Tech startup

$3M goes to 1 EV Tech startup

$17.2M goes to 1 BioTech startup

$18M goes to 1 Logistics startup

$32M goes to 1 Automotive startup

$15M goes to 1 Manufacturing startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

OpenAI raised $6.6B led by Thrive Capital

Poolside (AI for software engineering) raised $500M Series B led by Bain Capital Ventures

Resolve (software operations automation) raised $35M Seed led by Greylock

Voyage AI (search and retrieval for unstructured data) raised $20M Series A led by CRV

Harmonic Security (zero-touch data protection) raised $17.5M Series A led by Next47

Neeve (cloud platform-as-a-service for smart building) raised $15M Series A led by Cantor Fitzgerald & RXR

Artisan AI (AI virtual employees for sales teams) raised $11.5M Seed led by Oliver Jung

Reducto (data ingestion for LLMs) raised $8.4M Seed led by First Round Capital

Aspect Build (developer productivity platform for Monorepos) raised $3M Seed led by FirstMark Capital

Legal Tech

Billables AI (AI-powered timekeeping solution for legal professionals) raised $3.9M Seed led by Wing Venture Capital

EV Tech

Paren (EV charging data and analysis platform) raised $3M Seed led by Base10 Partners

BioTech

Integrated Biosciences (therapeutics for age-related diseases) raised $17.2M Seed led by Sutter Hill Ventures

Logistics

Pallet (unified transportation and warehouse management software) raised $18M Series A led by Bain Capital Ventures

Automotive

Numa (AI communication platform for auto dealerships) raised $32M Series B led by Touring Capital and Mitsui

Manufacturing

Valdera (AI sourcing platform for chemicals and raw materials) raised $15M Series A led by Index Ventures

IPO & M&A (300 miles radius from Silicon Valley)