14 Silicon Valley Startups Raised $362.1M - Week of June 23, 2025

📹 The Creator Economy is a Gold Mine for AI 🧠 Elon’s Startup Equation: Ego vs. Reality 💸 GENIUS Act is Officially Passed 🔌 Model Context Protocol (MCP) 101

Happy Monday!

Here are a few great things to read/watch this week coming out of Silicon Valley:

📹 The Creator Economy is a Gold Mine for AI - I really enjoyed attending VidCon in Anaheim last week — by far the #1 conference for video creators, drawing nearly 50,000 attendees annually. Since its acquisition by Informa in 2024 (Viacom was its previous owner (now Paramount) in 2018), the event has evolved alongside the platforms it celebrates - primarily YouTube, but also TikTok, Meta and more.

This year marks YouTube’s 20th anniversary, and one milestone says it all: YouTube now has more viewers on Connected TVs (CTV) than on mobile and desktop combined. That shift isn’t just cosmetic — it’s redefining how content is consumed, monetized, and built for the big screen.

YouTube is a gold mine for AI and not just a monetization powerhouse through ads and subscriptions — it’s also one of the largest living archives of real-world video data on the planet. Every frame uploaded becomes potential training fuel for the next wave of synthetic media, agent intelligence, and multimodal AI.

But YouTube is also playing defense — and playing it smart:

🔴 Vertical live streaming — its clearest shot at blunting TikTok and Instagram

💬 Enhanced community tools — turning creators into platform-native ecosystems

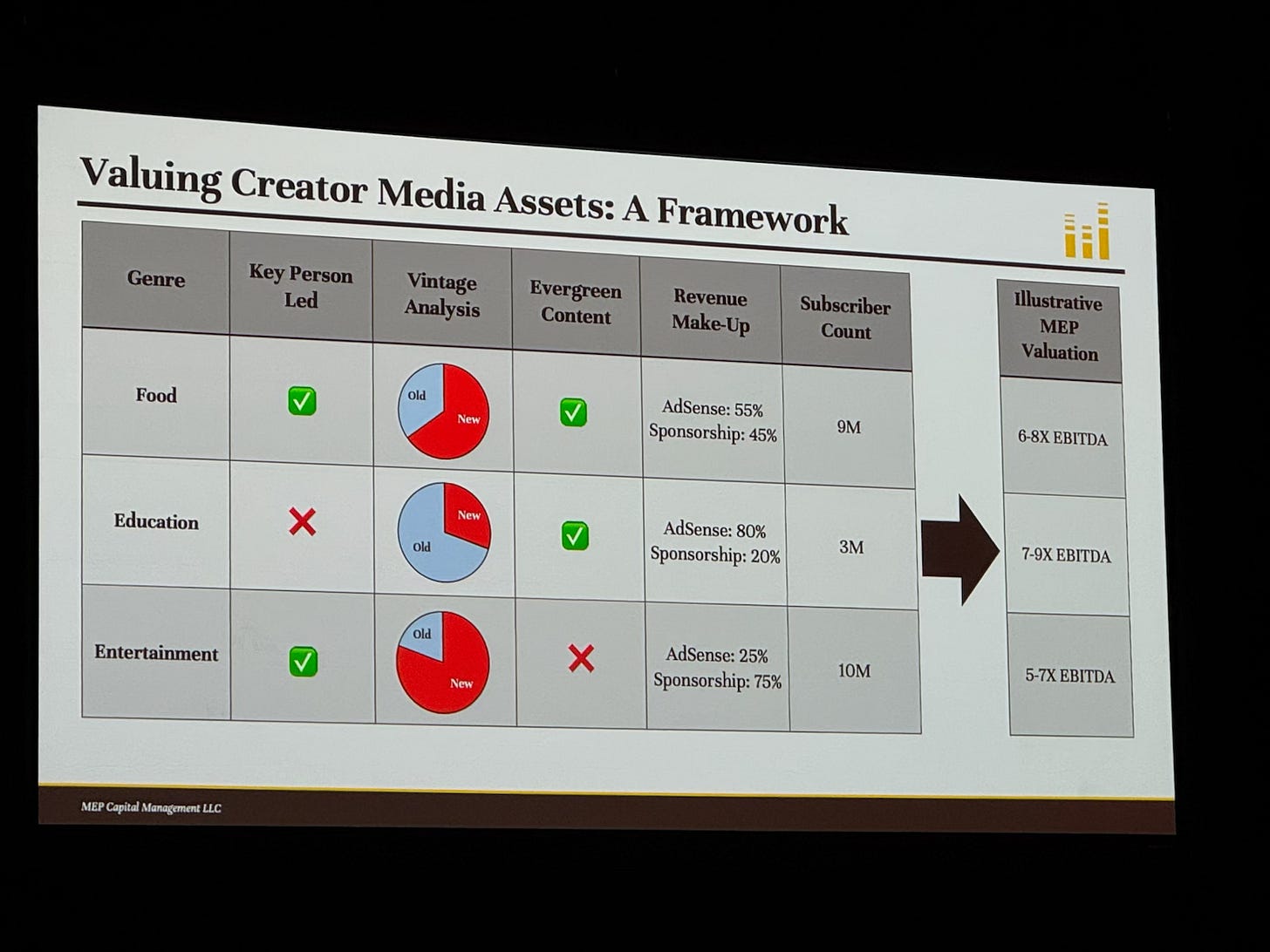

Here’s what’s catching investors’ attention: content startups are valued at 5–9x EBITDA multiples, far lower than their enterprise SaaS peers. And most early-stage investors now expect $2–3M in annual revenue just to take a seed meeting.

Here is the Culture and Trends Report that YouTube shared at their 20th Anniversary panel at VidCon 2025.

🧠 Elon’s Startup Equation: Ego vs. Reality — I really enjoyed Elon Musk’s talk at YC Startup School last week. In a world where too many founders are chasing the title of CEO rather than the mission, this was a timely reminder: building a company isn’t about status — it’s about solving real-world problems.

Startups don’t die from failure. They die from the refusal to accept the truth fast enough. To survive, founders must become brutal internalizers of responsibility. That means shrinking the ego, staying radically attuned to reality, and doing whatever the moment demands — whether it’s designing a rocket engine or sweeping the floor.

When one’s ego swells, it distorts signal.

You stop listening.

You start rationalizing.

And slowly, the feedback loop to reality breaks.

Keep your ego-to-ability ratio below 1.

Click here to watch his talk on YouTube.

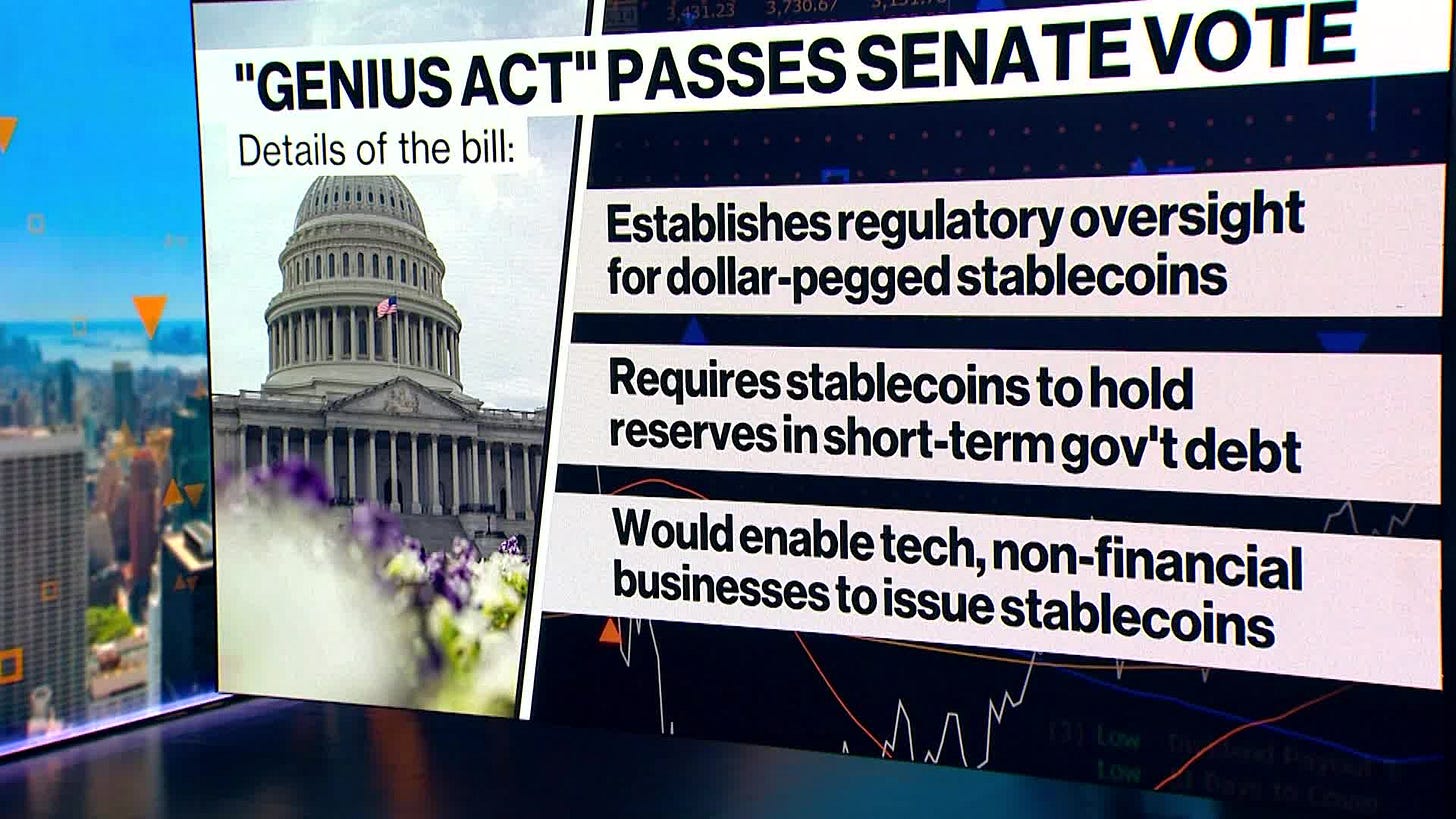

💸 GENIUS Act Is Officially Passed — The Senate passed the GENIUS Act this past week — a rare show of bipartisan momentum toward a U.S. stablecoin framework. In parallel, institutional dominoes began to fall.

Stripe deepened its partnership with Shopify, rolling out stablecoin acceptance across 34 countries. Coinbase launched Coinbase Payments, a full-stack stablecoin solution for commerce. Meanwhile, capital is backing the rails: Galaxy Ventures, Coinbase, and Founders Fund invested in Ubyx, a clearing system built by a 20-year Citigroup veteran.

JPMorgan unveiled JPMD, its institutional alternative to dollar-backed stablecoins. Quietly, both Walmart and Amazon are now exploring their own.

In just weeks, we’ve seen a cascade of signals — not from crypto natives, but from incumbents that once stood on the sidelines.

My prediction: Governments in the UAE, Singapore, and Hong Kong will follow soon - ushering a new wave of startups fueled by regulatory clarity. For example, here is the latest Hong Kong Web3 Blueprint 2025.

🔌 Model Context Protocol (MCP) 101 — What is MCP? The Model Context Protocol is a new open-source standard from Anthropic that acts like USB‑C for AI systems. It offers a universal, secure way for LLMs to connect with external data sources — think files, APIs, SQL databases, or productivity tools — without bespoke integrations.

In short, MCP makes AI agents smarter by giving them structured access to real-world context. And it does so with standardization that dramatically simplifies engineering.

For investors, this is one of those rare “plumbing layer” opportunities. Instead of every AI product building its own fragile adapter for tools and workflows, MCP becomes the protocol everyone can agree on. Think: faster build cycles, cleaner security, and far less custom code.

Watch this excellent MCP 101 video with Theo Chu, David Soria Parra, and Alex Albert as they walk through how MCP could become the next API layer for LLMs.

Last week a total of 13 startups raised $362.1M in funding, 0 exit:

$123.1M goes to 6 Enterprise startups

$142M goes to 2 FinTech startups

$23M goes to 1 HR startup

$11M goes to 1 eCommerce startup

$8M goes to 1 Crypto startup

$11M goes to 1 Robotics startup

$44M goes to 1 Public Safety startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Browserbase (browser based AI infrastructure) raised $40M Series B led by Notable Capital

Fleet (device management platform) raised $27M Series B led by Ten Eleven Ventures

Uncountable (R&D laboratory informatics platform) raised $27M Series A led by Sageview Capital

Sedai (cloud infrastructure automation) raised $20M Series B led by AVP

Typedef (AI workloads) raised $5.5M Seed led by Pear VC

Digger (terraform pull request automation) raised $3.6M Seed led by Initialized Capital

FinTech

Juniper Square (connected fund software and services for private markets) raised $130M Series D led by Ribbit Capital

Tensec (B2B cross-border financial services) raised $12M Seed led by Costanoa Ventures

HR

WorkWhile (AI-powererd flexible labor platform) raised $23M Series B led by Rethink Impact

eCommerce

Alta (agentic shopping) raised $11M Seed led by Menlo Ventures

Crypto

Robotics

PrismaX (robotics intelligence platform) raised $11M Seed led by a16z crypto

Public Safety

Pano AI (AI-powered wildfire management solution) raised $44M Series B led by Giant Ventures

IPO & M&A (300 miles radius from Silicon Valley)

N/A