11 Silicon Valley Startups Raised $356M - Week of April 14, 2025.

📝 Stanford's 2025 AI Index Report 🎂 YC Turned 20 💰 China’s Reaction Trump’s Tariff 💰 Crypto M&A Hit Record Levels 💰 Small Team is Beautiful 🇹🇷 Turkey is the Gaming Hub of Europe

Happy Monday!

The Tariff War seems to be changing lanes faster and more furiously than a Vin Diesel movie. 😬. Meanwhile, I’m happy to announce that I am hosting an invite-only FoundersHK meet-up with HKSTP (Hong Kong Science Park) at the Race Capital Palo Alto office this week. Apply to attend.

Here are a few great things to read/watch/learn this week:

🇹🇷 Turkey is the Gaming Hub of Europe - I had the great pleasure of speaking at the e2day Summit in Istanbul last week, hosted by Enis Hulli and Arın Özkula. I left feeling incredibly inspired by the energy of Turkish founders, and I learned several fascinating insights about Turkey’s vibrant startup ecosystem.

Gaming - Turkey’s gaming industry is huge. Zynga’s $1.8 billion acquisition of Peak Games not only made headlines but also produced a “Peak Games mafia”—a wave of gaming founders who are now driving new ventures across the sector.

Economy - Over the past 5 years, the Turkish lira has dropped about 80% in value. This steep currency devaluation forces local startups to adjust their pricing on a monthly basis to keep pace with inflation and currency fluctuations.

Crypto - Turkey’s crypto industry is booming, with user penetration is projected to be 30.24% in 2025.

Unicorns - Turkish founders have launched numerous unicorns, including Udemy, Carbon, Insider, Dream Games, Peak Games, and Getir, showcasing the country’s impressive track record in creating high-value startups.

Demographics - With a population of 87 million and a median age of 33.5, Turkey benefits from a large, youthful, and growing consumer base.

📝 Stanford's 2025 AI Index Report - This 456-page report offers insights into AI’s technical advancements, economic influence, and societal impact. Here are some key highlights:

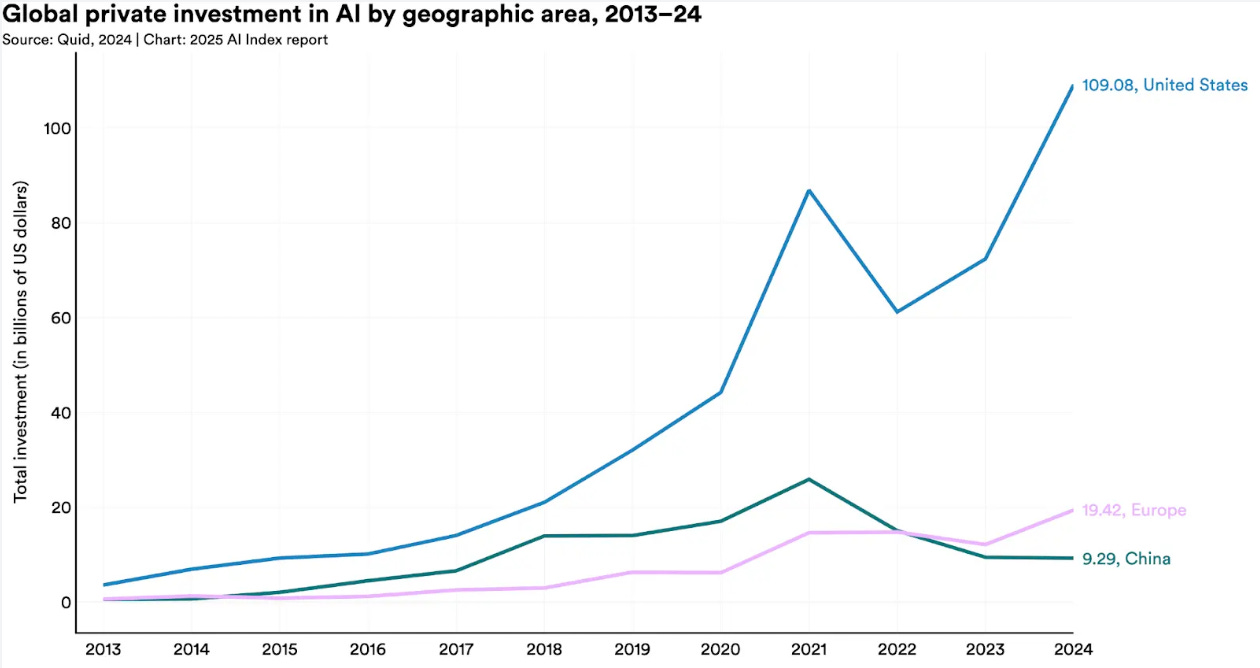

Private Investment Surpasses $100B: In 2024, private investment in U.S. AI reached $109.1 billion—nearly 12X China's $9.3 billion and 24X the U.K.’s $4.5 billion. Generative AI specifically attracted $33.9 billion globally, marking an 18.7% increase over 2023.

China Narrowing the AI Gap: In 2024, U.S.-based institutions developed 40 notable AI models, compared to China's 15 and Europe's three. However, China remains a leader in AI research, accounting for the highest number of AI publications (23.2%) and citations (22.6%) globally.

Government Engagement Intensifies: U.S. federal agencies introduced 59 new AI-related regulations in 2024. Global governmental investment has also surged, with notable commitments including Canada's $2.4 billion pledge, China's $47.5 billion semiconductor fund, France’s €109 billion initiative, India's $1.25 billion commitment, and Saudi Arabia’s $100 billion Project Transcendence.

🇨🇳 China’s Reaction Trump’s Tariff - The decision-making process behind China's trade war is driven primarily by politics, not economics. It is not economically advantageous for China to impose 125% tariffs on U.S. goods; rather, it serves political objectives.

Critical Minerals Export Suspension - China has halted exports of essential minerals and magnets, potentially disrupting supply chains for automakers, aerospace manufacturers, semiconductor firms, and military contractors. (NYT)

New AI Investment Fund - China is launching an AI-focused fund that will inject US$8 billion into early-stage projects. (SCMP)

Impact on Australian Beef Exports - Due to escalating U.S.-China trade tensions, Australian beef exports to China have significantly increased, filling the gap left by restrictions on U.S. beef producers. (ABC News)

China Loads Up on Brazilian Soybeans (Bloomberg)

JD.com Pledges $27 Billion to Help Chinese Exporters - JD.com will provide training to export-oriented manufacturers and purchase 200 billion yuan, equivalent to $27 billion, of goods from China’s exporters in the coming year. (WSJ)

President Xi’s Southeast Asia Visit - President Xi Jinping is set to visit Vietnam, Cambodia, and Malaysia this to reinforce regional relationships and strengthen diplomatic ties. (Reuters)

💰 Small Team is Beautiful - Great reminder post by Howie Xu: while many founders love to highlight how much they've raised, the real metric of success — and the KPI worth celebrating — is revenue growth!

💰 Crypto M&A Hit Record Levels in Q1 2025 - According to Architect Partners’ latest report, 61 deals and $2.2 billion in total transaction in Q1 2025. Kraken’s $1.5 billion acquisition of NinjaTrader in March was the largest crypto deal to date. As the second quarter gets underway, Ripple’s $1.25 billion deal for prime brokerage Hidden Road this week is not far behind it. (Bloomberg)

🎂 YC Turned 20 - Founded in 2005 by Paul Graham, Jessica Livingston, Robert Tappan Morris, and Trevor Blackwell, Y Combinator (YC) started its first batch in Cambridge, Massachusetts. Read the original story by clicking here.

Last week a total of 11 startups raised $355.8M in funding, 5 exits:

$274.2M goes to 7 Enterprise startups

$9.5M goes to 1 EdTech startup

$11M goes to 1 Environmental startup

$3.1M goes to 1 Hospitality startup

$58M goes to 1 Hardware startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Rescale (AI-driven digital engineering platform) raised $115M Series D from Applied Ventures, Atika Capital, Foxconn, Hanwha Asset Management Deeptech Venture Fund, Hitachi Ventures, NEC Orchestrating Future Fund, NVIDIA, Prosperity7, SineWave Ventures, Translink Capital, University of Michigan, and Y Combinator

Tessell (multi-cloud database-as-a-service) raised $60M Series B led by WestBridge Capital

Anecdotes (governance and compliance platform) raised $30M Series B led by DTCP

Aurascape (AI-native security platform) raised $26.2M Series A led by Mayfield Fund, Menlo Ventures

Artisan AI (AI sales agent) raised $25M Series A led by Glade Brook Capital Partners

8Flow (enterprise workflow automation) raised $10M Series A led by Caffeinated Capital

Authorium (cloud-based platform for government operations) raised $8M Series A led by SJF Ventures

EdTech

SigIQ (personalized AI tutoring) raised $9.5M Seed led by GSV Ventures, The House Fund

Environmental

Remedy Scientific (environmental remediation automation) raised $11M Seed led by Eclipse Ventures

Hospitality

Hardware

IPO & M&A (300 miles radius from Silicon Valley)