10 Silicon Valley Startups Raised $470M - Week of May 5, 2025

💰 Lessons Learned from Roelof Botha of Sequoia Capital 🦙 LlamaCon 2025 Highlights 📈 Threads Tops 350M MAU 💰 Silicon Valley VCs Are Turning Into PE 🩸 White House Tech Bros Are Killing Universities

Happy Monday!

Here are a few great things to read/watch this week:

💰 Lessons from 20 Years of Venture Capital: Roelof Botha - I was struck by something Roelof (Managing Partner at Sequoia Capital) said as being a venture investor:

Our job is to invest in the future, to buy at a discount to what could be — not pay a premium for what already was.

It sounds simple. But in practice, it’s one of the hardest psychological hurdles we investors face. We’re wired to look for validation in the past: revenue milestones, growth rate, social proof. The real work, though — the real courage — is in resisting that impulse.

It’s easy to make relative decisions, especially when comparing a few companies in the same category. But the best investors stretch beyond that. They widen the aperture. They look for different frameworks, fresh signals, and contrarian possibilities. It’s part of what’s made Sequoia a generational firm. It is really not easy to have that kind of investor discipline — and in that optimism about what’s next. Watch Roelof with The Generalist.

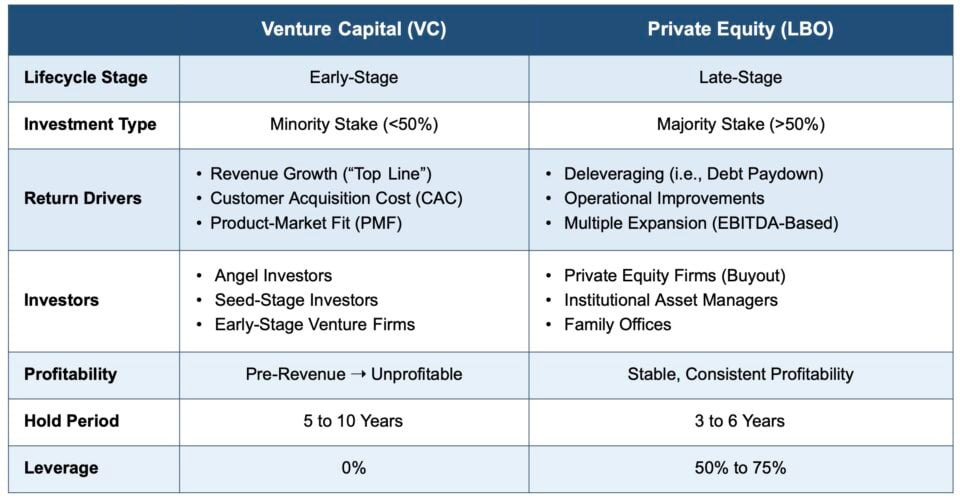

💰 Silicon Valley VCs Are Turning Into Private Equity - Lightspeed. a16z. Sequoia. Thrive. VC firms are no longer just betting on startups — they’re buying, rolling up their sleeves, and rebuilding companies just like Blackstone but in hoodies.

The catalyst? RIA status. Lightspeed just registered as a Registered Investment Advisor, unlocking the ability to invest in public stocks, secondaries, and control-style buyouts — with none of the old VC limits. This isn’t just regulatory housekeeping. It’s a structural shift. VCs are now:

Launching and acquiring companies.

Using AI to modernize legacy businesses.

Building secondaries platforms to drive liquidity.

From a16z’s crypto empire to General Catalyst’s hospital acquisition, the line between VC and PE is blurring. Read more on Bloomberg.

🩸 White House Tech Bros Are Killing What Made Them (and America) Wealthy - Basic research from America’s universities is the foundation of our startup engine. If the administration’s campaign against American universities continues unchecked, the damage to Silicon Valley competitiveness is probably measured in decades. The geographic centers of venture capital and the industries it has spawned overlap precisely with the locations of our great research universities. Think of Cambridge and Route 128 around Boston (MIT and Harvard), or the stretch from San Jose to San Francisco (Stanford and Berkeley). This is no accident. It’s why world leaders visit these places to understand how we do it.

Read this NYT Opinion piece by David Singer.

🦙 LlamaCon 2025 Highlights - During a fireside chat at Meta’s LlamaCon this week, Microsoft CEO Satya Nadella shared a remarkable stat: 20% to 30% of the code in Microsoft’s repositories is now written by AI. And Mark Zuckerberg said this number may soon go up to 50%.

Let that sink in. This isn’t a hypothetical future — it’s already reshaping the way one of the world’s largest tech companies builds software. At the same event, Meta announced that its Llama AI model family has now been downloaded 1.2 billion times — nearly doubling from 650 million just five months ago.

We’re witnessing the quiet rewriting of what “work” means in tech. When AI starts contributing a third of the codebase at a company like Microsoft, it forces us to rethink how teams collaborate, how products are built, and ultimately, what the role of the human engineer becomes.

📈 Meta’s Threads Tops 350M Monthly Users — Launched in July 2023, Threads is still trailing X (according to CEO Mark Zuckerberg during Meta’s Q1 2025 earnings call) which now reports over 600 million MAUs per X’s CEO Linda Yaccarino. But the trajectory is hard to ignore: in less than two years, Threads has become the fastest-growing text-based social platform in recent memory — a signal that the battle for digital public square dominance is far from over. Read more on Techcrunch.

Last week a total of 10 startups raised $469.6M in funding, 2 exits:

$331.5M goes to 4 Enterprise startups

$46.7M goes to 2 FinTech startups

$14.4M goes to 1 Crypto startup

$61M goes to 2 Healthcare startups

$16M goes to 1 Robotics startup

If you love this newsletter, forward it to someone who would also enjoy it and have them subscribe.

Edith

X, LinkedIn

Funding (300 miles radius from Silicon Valley)

Enterprise

Persona (verified identity platform) raised $200M Series D led by Founders Fund, Ribbit Capital

Veza (identity security platform) raised $108M Series D led by New Enterprise Associates

Gruve (enterprise AI services platform) raised $20M Series A led by Mayfield Fund

Blacksmith (high-performance CI cloud) raised $3.5M Seed led by Google Ventures, Y Combinator

FinTech

Nuvo (B2B trade credit platform) raised $34M Series A led by Sequoia Capital, Spark Capital

Dinari (securities backed tokens) raised $12.7M Series A led by Blockchange Ventures, Hack VC

Crypto

Unto Labs (Layer-1 blockchain) raised $14.4M Seed led by Electric Capital, Framework Ventures

Healthcare

Plenful (healthcare workflow automation platform) raised $50M Series B led by Arena Holdings, Michell Rales

Trek Health (healthcare payment and insurance workflow automation platform) raised $11M Series A led by Madrona

Robotics

Glacier (recycling robotics) raised $16M Series A led by Ecosystem Integrity Fund

IPO & M&A (300 miles radius from Silicon Valley)